Optimize Your Economic Versatility With Fast Approval Online Loans

Rapid approval on-line fundings have actually emerged as a calculated tool for individuals looking for to optimize their monetary flexibility. As we dive right into the world of rapid approval on the internet financings, we uncover a world where speed fulfills fiscal vigilance, encouraging people to seize control of their economic destinies.

Advantages of Rapid Approval Online Loans

When looking for monetary assistance, opting for rapid authorization on the internet financings can supply individuals with swift access to much-needed funds. With simply a few clicks, borrowers can finish the application procedure from the comfort of their very own homes, removing the need to visit a physical financial institution or monetary organization.

One more advantage of rapid approval on-line fundings is the rate at which funds can be disbursed. Oftentimes, borrowers can receive approval within hours, permitting them to attend to immediate financial requirements quickly. This fast accessibility to funds can be specifically valuable in emergency scenarios or when unanticipated expenses arise.

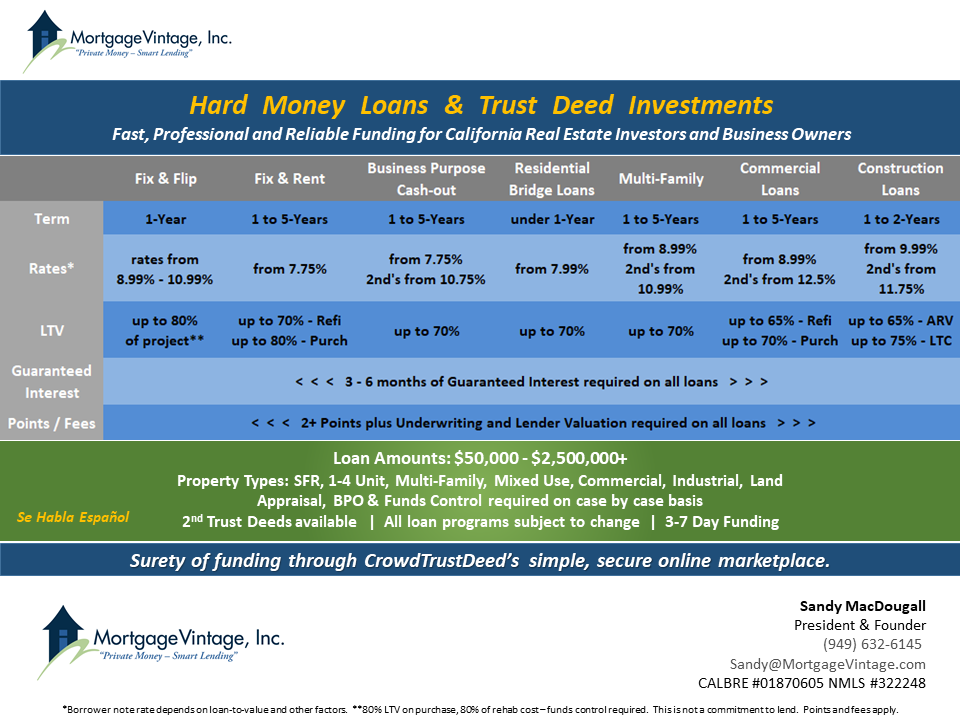

In addition, quick authorization on the internet car loans might offer a lot more affordable rates of interest and terms contrasted to traditional borrowing choices. By going shopping around and contrasting various online loan providers, borrowers can discover a car loan that matches their monetary circumstance and demands. On the whole, fast authorization online car loans offer a convenient, reliable, and adaptable means to access funds when needed.

Just How to Apply for Online Loans

To initiate the process of applying for online lendings, individuals can begin by selecting a reliable online loan provider that lines up with their monetary requirements and preferences. Investigating different loan providers is necessary to discover one that uses affordable rates of interest, favorable settlement terms, and a safe online system for loan applications. As soon as a suitable lending institution is picked, the person can visit their website to start the application procedure.

Normally, the on the internet loan application will call for individual information such as name, address, call information, work status, income information, and banking details. It is crucial to give precise information to expedite the authorization process. Some lenders might likewise require added paperwork to verify the given details.

After sending the on the internet application, the lender will certainly examine the details supplied and perform a debt check to examine the person's credit reliability. bad credit loans edmonton. If accepted, the funds can be paid out swiftly, often within the same day. It is vital to evaluate the funding terms meticulously before approving the deal to make sure complete understanding of the payment commitments

Quick Approval Process Described

Checking out the rapid assessment techniques utilized by online lending institutions clarifies the quick authorization procedure for lendings. On the internet loan providers utilize progressed formulas and innovation to simplify the lending application review procedure, allowing for quick decisions on lending approvals. One crucial variable contributing to the fast approval view website procedure is the automated verification of applicant information. By online validating details such as earnings, work standing, and banking info, on-line loan providers can promptly examine an individual's creditworthiness and make enlightened loaning decisions in a matter of mins.

Additionally, on-line loan providers frequently have marginal documents needs compared to traditional financial institutions, further accelerating the approval procedure. Candidates can conveniently upload necessary files online, removing the need for in-person sees or prolonged paperwork submissions. In addition, the ability to send funding applications 24/7 means that borrowers can get authorization within hours, giving unrivaled rate and comfort in accessing much-needed funds. By prioritizing effectiveness and innovation, on the internet loan providers are changing the loaning landscape, supplying borrowers a seamless and fast borrowing experience.

Tips for Handling Loan Repayments

Reliable administration of car loan settlements is essential for maintaining economic security and growing a positive credit account. To efficiently take care of car loan repayments, begin by creating a budget plan that includes your month-to-month payment commitments. Prioritize these repayments to guarantee they are made promptly, which can assist you stay clear of late charges and adverse marks on your credit scores record. Take into consideration setting up automatic repayments to simplify the procedure and reduce the danger of missing out on a settlement.

Furthermore, take into consideration making additional payments when feasible to decrease the total rate of interest paid and reduce the repayment duration. By staying arranged, communicating honestly, and making critical monetary decisions, you can successfully handle your browse around this web-site car loan settlements and keep your financial well-being.

Financial Flexibility Techniques

Keeping monetary flexibility requires tactical preparation and a positive approach to economic administration. One more essential aspect of monetary flexibility is establishing an emergency situation fund to cover unforeseen expenses without hindering your long-lasting financial objectives. Additionally, regularly evaluating and adjusting your monetary plan in action to changes in your revenue, costs, or financial goals is essential for remaining versatile and resilient in the face of unpredicted situations.

Verdict

In conclusion, quick authorization online financings provide countless benefits such as fast access to funds and versatility in taking care of finances. By following the application process and handling settlements effectively, individuals can maximize their economic flexibility and achieve their goals. personal loans calgary. It is important to comprehend the terms of the car loan to make educated decisions and preserve financial security. Making use of online car loans can be a useful device in attaining economic objectives and resolving unanticipated costs.